Enterprise AI that makes people superhuman.

We’re a leading enterprise AI software, applications, and services provider on a mission — advancing AI to empower people to be even better.

Empowering industries starts with empowering people.

Find the clue that solves the case, unlock new revenue streams with your media content, or find the best people to supercharge your teams — this is AI that makes you even better.

Media + Entertainment

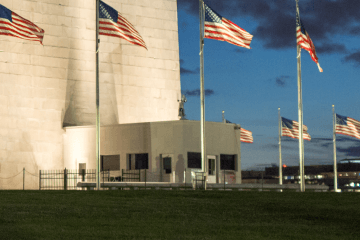

Public Sector

Talent Acquisition

Other industries

Unlock the power of your content.

Go from endless searching and editing to automating and monetizing with intelligent tools that help lead, innovate, and transform media management at the pace of demand. With AI solutions for Media + Entertainment, rights owners, rights holders, and creators can think bigger and enhance returns from their most valuable asset — their content.

LA Chargers

Using AI to complete 371 days of metadata work in hours.

ASSET MANAGEMENT

COST REDUCTION

Less taskwork, more time to serve.

Automate lengthy and tedious manual processes with powerful AI solutions made for law enforcement agencies and legal teams. Veritone’s AI for the public sector can save hundreds of hours so they can spend more time keeping communities safe.

Pasadena Police Department

See how the Pasadena Police Department turned two weeks of redaction time into two days with AI.

PUBLIC SAFETY

PRODUCTIVITY

Superhuman Resources start here.

Empower your talent acquisition team to find the best-fit candidates even faster with AI tools that optimize ad spend and hiring workflows. This is hiring as you’ve never seen it before.

Dominos

How a franchise of the global pizza leader increased their talent pipeline while reducing their costs.

RETAIL

TALENT ACQUISITION

AI solutions, ready for all.

Whether it’s in healthcare, finance, retail, or another field, our AI solutions have helped businesses elevate what they are capable of doing. With these tools, countless businesses have grown their revenue, increased efficiency, and delivered effective results for their customers.

Healthcare

Created a billing-centric platform enabling reduced administrative costs and optimized revenue.

EFFECTIVENESS

AUTOMATION

Custom AI, built for you.

Build, implement, and deploy enterprise AI that was developed to fit your organization’s needs. Our team will develop a customized solution to meet your goals, from specially designed workflows to end-user applications.

Let’s get startedaiWARE.

The OS for AI.

Veritone aiWARE is a customizable platform designed to fit your organization’s unique needs and objectives. We’ve helped some of the world’s biggest brands turn data into intelligence with ultimate efficiency, and we can do the same for you.

Learn moreAI for

good.

We believe in AI that can help people achieve greater potential than ever before. Our core set of principles guides every decision we make, making sure our technology isn’t just AI, it’s AI for a better world.

Read our philosophyLatest updates

Only show updates from Veritone

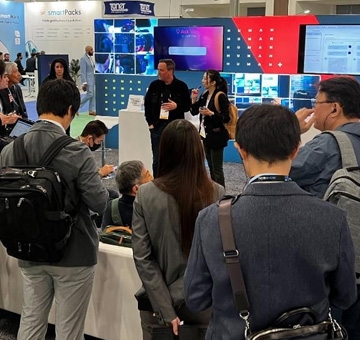

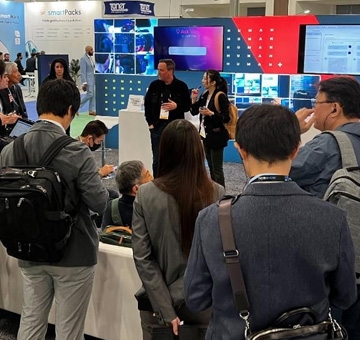

Reflecting on #NABShow2024, and the memories are still vivid! Huge thanks to everyone who visited our booth and engaged with us. Let's keep the #AI dialogue alive - together! Special shoutout to our amazing team for their dedication each day, highlighting Veritone's innovative solutions in the media industry and beyond🎥 We couldn't have asked for a better event to unveil our rebrand!

Balancing privacy and public safety is key to AI integration 👏 Read more from Jon Gacek and Unite.AI about using AI tracking methods beyond facial recognition

Exciting news 📣 Veritone and OPEXUS have partnered to provide AI solutions to the National Canadian Bank, integrating Veritone's Redact solution into OPEXUS's AI Assist Module for efficient redaction of sensitive information in audio and video data to enhance data privacy workflows and regulatory compliance. More on the partnership here: https://lnkd.in/gexqPzH4

Join Ryan Steelberg, CEO of Veritone, Phillip Shoemaker, Executive Director of identity.com, and Carm Taglienti, Chief Data Officer of Insight, as they chat with Jill Malandrino on Nasdaq TradeTalks about establishing a solid foundation for #AI innovation and creating an ethical platform. Watch here: https://lnkd.in/d75UUGJG

Government agencies regularly face unprecedented pressure to do their jobs more efficiently, often with shrinking budgets. Veritone is committed to empowering public sector agencies to expand what’s humanly possible through the help of #AI so they can focus on their primary mission and purpose.

Elevate your broadcasting game with Veritone's upgraded Advertising and Content Intelligence Suite (ACI)! 🌟 Our latest enhancements prioritize data privacy, Industry benchmarks, seamless data sharing, and automated insights for optimized ad revenues. Join us at the 2024 NAB Show in Las Vegas to experience the future of media management at booth #W1642! #NABShow2024 #ACI #AI

Join the discussion at NAB! "Filmmakers and AI: Are we doomed?" Ryan Steelberg, CEO of Veritone, and other industry experts will be joining the exciting roundtable on April 16, 3:30 PM – 4:30 PM in Central Hall at the Pro Video Coalition Booth C3334. Lean into AI's impact, job augmentation, and the future of filmmaking!

We are pleased to announce that Veritone and Grabyo have teamed up to reshape digital content production for sports organizations 🎥 The integration blends #AI-powered content management with live editing tools, enhancing efficiency in asset publishing and audience engagement. Visit the 2024 NAB Show in Las Vegas from April 13-17 to witness our innovative collaboration🤝 More about the partnership here: https://lnkd.in/gvQYJVm2

🎉 We're thrilled to announce that Veritone has been named a 2024 Govies Gold Winner in Artificial Intelligence for the second consecutive year with Security Today! Our #iDEMS platform revolutionizes digital evidence management with cutting-edge AI technology, empowering law enforcement and legal professionals to streamline their workflows. More on iDEMS and our award here: https://lnkd.in/gwG-kPeN

What a great session we had at the Amazon Web Services (AWS) Partner Village Theater here at #NABShow with Sean King, SVP at Veritone; Carin Forman, Global Partner Lead Amazon Web Services (AWS); Kenneth Ye from Creative Artists Agency; and Frank Gonzalez, VP at CBS News! A big thank you to those who came and listened in on how the media industry is setting the standard in utilizing AI to manage assets, create content, and more! Let us know your thoughts💭

Veritone is proud to introduce our new brand identity. Our mission is to advance and democratize the capabilities of AI and empower people to do even better than their best. Join us in our new era to discover how enterprise AI is helping advance humanity. We're Veritone: AI that makes you even better.

Thank you for joining us at the #NABShow 2024 for the NSI Research session with Ted Wakayama for Industry Analysts!🎉 Our team is thrilled to have met with prospective customers eager to explore how Veritone Digital Media Hub (DMH) works🧠 Your interest in managing content with us means the world. Let's continue the conversation and unlock new possibilities together!

👀 Our Veri amazing team is on the floor and ready to connect with you at the NAB Show, booth #W1642! Experience our Ask Veri sessions, Digital Media Hub, Advertising Content Intelligence, and so much more 👏 See you there!#NABShow #AskVeri #DMH #AI

We’re thrilled to announce that we have received the NAB Show Product of the Year Award for the fifth time! Our new generative AI-enabled chat-based media intelligence tool, Ask Veri, was recognized in the AI and Machine Learning category. Congratulations to our team on this exciting achievement! Read more here: https://lnkd.in/g-qZPQyj

Reflecting on #NABShow2024, and the memories are still vivid! Huge thanks to everyone who visited our booth and engaged with us. Let's keep the #AI dialogue alive - together! Special shoutout to our amazing team for their dedication each day, highlighting Veritone's innovative solutions in the media industry and beyond🎥 We couldn't have asked for a better event to unveil our rebrand!

Balancing privacy and public safety is key to AI integration 👏 Read more from Jon Gacek and Unite.AI about using AI tracking methods beyond facial recognition

Exciting news 📣 Veritone and OPEXUS have partnered to provide AI solutions to the National Canadian Bank, integrating Veritone's Redact solution into OPEXUS's AI Assist Module for efficient redaction of sensitive information in audio and video data to enhance data privacy workflows and regulatory compliance. More on the partnership here: https://lnkd.in/gexqPzH4

Join Ryan Steelberg, CEO of Veritone, Phillip Shoemaker, Executive Director of identity.com, and Carm Taglienti, Chief Data Officer of Insight, as they chat with Jill Malandrino on Nasdaq TradeTalks about establishing a solid foundation for #AI innovation and creating an ethical platform. Watch here: https://lnkd.in/d75UUGJG

Government agencies regularly face unprecedented pressure to do their jobs more efficiently, often with shrinking budgets. Veritone is committed to empowering public sector agencies to expand what’s humanly possible through the help of #AI so they can focus on their primary mission and purpose.

Elevate your broadcasting game with Veritone's upgraded Advertising and Content Intelligence Suite (ACI)! 🌟 Our latest enhancements prioritize data privacy, Industry benchmarks, seamless data sharing, and automated insights for optimized ad revenues. Join us at the 2024 NAB Show in Las Vegas to experience the future of media management at booth #W1642! #NABShow2024 #ACI #AI

Join the discussion at NAB! "Filmmakers and AI: Are we doomed?" Ryan Steelberg, CEO of Veritone, and other industry experts will be joining the exciting roundtable on April 16, 3:30 PM – 4:30 PM in Central Hall at the Pro Video Coalition Booth C3334. Lean into AI's impact, job augmentation, and the future of filmmaking!

We are pleased to announce that Veritone and Grabyo have teamed up to reshape digital content production for sports organizations 🎥 The integration blends #AI-powered content management with live editing tools, enhancing efficiency in asset publishing and audience engagement. Visit the 2024 NAB Show in Las Vegas from April 13-17 to witness our innovative collaboration🤝 More about the partnership here: https://lnkd.in/gvQYJVm2

🎉 We're thrilled to announce that Veritone has been named a 2024 Govies Gold Winner in Artificial Intelligence for the second consecutive year with Security Today! Our #iDEMS platform revolutionizes digital evidence management with cutting-edge AI technology, empowering law enforcement and legal professionals to streamline their workflows. More on iDEMS and our award here: https://lnkd.in/gwG-kPeN

What a great session we had at the Amazon Web Services (AWS) Partner Village Theater here at #NABShow with Sean King, SVP at Veritone; Carin Forman, Global Partner Lead Amazon Web Services (AWS); Kenneth Ye from Creative Artists Agency; and Frank Gonzalez, VP at CBS News! A big thank you to those who came and listened in on how the media industry is setting the standard in utilizing AI to manage assets, create content, and more! Let us know your thoughts💭

Veritone is proud to introduce our new brand identity. Our mission is to advance and democratize the capabilities of AI and empower people to do even better than their best. Join us in our new era to discover how enterprise AI is helping advance humanity. We're Veritone: AI that makes you even better.

Thank you for joining us at the #NABShow 2024 for the NSI Research session with Ted Wakayama for Industry Analysts!🎉 Our team is thrilled to have met with prospective customers eager to explore how Veritone Digital Media Hub (DMH) works🧠 Your interest in managing content with us means the world. Let's continue the conversation and unlock new possibilities together!

👀 Our Veri amazing team is on the floor and ready to connect with you at the NAB Show, booth #W1642! Experience our Ask Veri sessions, Digital Media Hub, Advertising Content Intelligence, and so much more 👏 See you there!#NABShow #AskVeri #DMH #AI

We’re thrilled to announce that we have received the NAB Show Product of the Year Award for the fifth time! Our new generative AI-enabled chat-based media intelligence tool, Ask Veri, was recognized in the AI and Machine Learning category. Congratulations to our team on this exciting achievement! Read more here: https://lnkd.in/g-qZPQyj

Reflecting on #NABShow2024, and the memories are still vivid! Huge thanks to everyone who visited our booth and engaged with us. Let's keep the #AI dialogue alive - together! Special shoutout to our amazing team for their dedication each day, highlighting Veritone's innovative solutions in the media industry and beyond🎥 We couldn't have asked for a better event to unveil our rebrand!

Balancing privacy and public safety is key to AI integration 👏 Read more from Jon Gacek and Unite.AI about using AI tracking methods beyond facial recognition

Exciting news 📣 Veritone and OPEXUS have partnered to provide AI solutions to the National Canadian Bank, integrating Veritone's Redact solution into OPEXUS's AI Assist Module for efficient redaction of sensitive information in audio and video data to enhance data privacy workflows and regulatory compliance. More on the partnership here: https://lnkd.in/gexqPzH4

Join Ryan Steelberg, CEO of Veritone, Phillip Shoemaker, Executive Director of identity.com, and Carm Taglienti, Chief Data Officer of Insight, as they chat with Jill Malandrino on Nasdaq TradeTalks about establishing a solid foundation for #AI innovation and creating an ethical platform. Watch here: https://lnkd.in/d75UUGJG

Adopt AI that brings out the best in your teams.

Ready for proven, trusted enterprise AI solutions that can turn possibilities into profits, deliver better results, and make your people better than ever before?